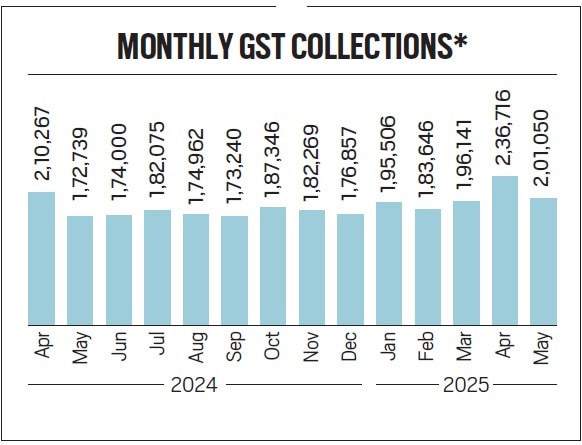

Gross Goods and Services Tax (GST) collections rose 16.4 per cent year-on-year to Rs 2.01 lakh crore in May (for sales in April), data released by the government on Sunday showed. The GST collections in May were lower than last month’s record-high level of Rs 2.37 lakh crore even as the growth rate was higher at 16.4 per cent in May as against 12.6 per cent growth seen in April.

While April collections had gained from year-end sales, GST collections in May slowed down from the domestic segment. GST collections from imports grew 25.2 per cent year-on-year to Rs 51,266 crore in May. GST collections from imports were Rs 46,913 crore in April. On the domestic front, GST collections grew 13.7 per cent to Rs 1.50 lakh crore in May, but were lower than Rs 1.90 lakh crore in April. On a net basis, GST collections increased 20.4 per cent to Rs 1.74 lakh crore, the data showed. Experts said a 16 per cent plus year-on-year growth implies economic recovery is holding up.

Abhishek Jain, indirect tax head and partner, KPMG said, “While last month’s spike was expected with year-end reconciliations, the consistency this month along with a 16 plus per cent year-on-year growth points to strong underlying momentum and a recovery that’s clearly taking hold.”

Some experts pointed out a lower GST collection from the domestic sales in May (for sales in April) as against April (for year-end sales in March). “GST collections are about what we expected, showing a 15 per cent drop from last month. However, domestic GST collections fell by nearly 21 per cent compared to last month, suggesting a shift in how much consumers are spending. While last month’s higher collections likely included year-end business-to-business sales pushed due to targets, this large decrease points to some bit of change in consumer spending possibly due to global uncertainties. Also, export refunds are down significantly, by 36.25 per cent, which suggests that the last month’s increased exports were primarily on account of companies building their stock at US level due to imposition of tariff,” Saurabh Agarwal, tax partner, EY India said.

Total refunds stood at Rs 27,210 crore in May, down 4 per cent YoY. While domestic refunds grew 53.7 per cent YoY to Rs 18,314 crore in May, refunds for imports were down 45.9 per cent to Rs 8,896 crore.

In April, domestic refunds had risen 22.4 per cent YoY to Rs 13,386 crore, while refunds on imports had increased 86.1 per cent YoY to Rs 13,955 crore.

State-wise data for October showed that out of 38 states/Union territories, 20 states/UTs recorded higher growth in gross GST collections than the national average of 16.4 per cent growth rate.

Story continues below this ad

In absolute terms, Maharashtra was at the top with collection of Rs 31,530 crore (17 per cent growth), followed by Karnataka with collection of Rs 14,299 crore (20 per cent growth), Tamil Nadu with Rs 12,230 crore (25 per cent growth), Gujarat with collection of Rs 11,737 crore (4 per cent growth), and Delhi with Rs 10,366 crore collection (38 per cent growth).

States/UTs which recorded a contraction in GST collections in May included: Andhra Pradesh at Rs 3,803 crore (-2 per cent), Uttarakhand at Rs 1,605 crore (-13 per cent), Dadra and Nagar Haveli and Daman & Diu at Rs 351 crore (-6 per cent), and Mizoram at Rs 29 crore (-26 per cent).

“The wide variations in the growth of GST collections across states require a thorough analysis across the sectors that are important in each state. While large states like Maharashtra, West Bengal, Karnataka and Tamil Nadu have reported collection increases of 17 per cent to 25 per cent, similar large states like Gujarat, AP and Telangana have shown increases of only -2 per cent to 6 per cent t. Some states like MP, Haryana, Punjab and Rajasthan have shown a median increase of 10 per cent. Hence, the average growth across the country does not appear to be uniformly reflected across states possibly due to sectoral or seasonal factors which require a deeper data based analysis,” MS Mani, partner, indirect taxes, Deloitte India said.

The gross Central GST (CGST) — the tax levied on intra-state supplies of goods and services by the Centre — collections stood at Rs 35,434 crore, State GST (SGST) — the tax levied on intra-state supplies of goods and services by the states — collections were Rs 43,902 crore, while Integrated GST (IGST) — the tax levied on all inter-state supplies of goods and services — collections stood at Rs 1.09 lakh crore and cess at Rs 12,879 crore during the month.

Story continues below this ad

The gross Central GST (CGST) — the tax levied on intra-state supplies of goods and services by the Centre — collections stood at Rs 35,434 crore, State GST (SGST) — the tax levied on intra-state supplies of goods and services by the states — collections were Rs 43,902 crore, while Integrated GST (IGST) — the tax levied on all inter-state supplies of goods and services — collections stood at Rs 1.09 lakh crore and cess at Rs 12,879 crore during the month.