A fresh tweak in America’s tariffs on China has policymakers in New Delhi reaching for their calculators again for a keenly tracked metric here — the effective duty on Chinese products on a landed basis across US ports in commodity categories where Indian producers are reasonably competitive.

The net tariff differential with India, and how that curve continues to move, is of particular interest here, given the firm belief in policy circles here that Washington DC would ensure a reasonable tariff differential between China and India. This is, in turn, expected to tide over some of India’s structural downsides — infrastructural bottlenecks, logistics woes, high interest cost, the cost of doing business, corruption, etc.

On the face of it, Trump’s announcement of 55 per cent tariffs on China theoretically means a near 30 percentage point tariff differential when compared with the 26 per cent levy on India for now.

But there are a few caveats here:

One, for the Donald Trump administration, whose tariff proposals generally have had a half life of less than 10 days, it is not clear how long the new tariffs announced on China after the latest round of talks between the two sides in London would last.

Secondly, in the talks held by the two sides earlier in Geneva in May that led to a temporary truce, US tariffs on Chinese products were brought down from 145 per cent to 30 per cent and Beijing slashed levies on US imports to 10 per cent, while promising to lift barriers on critical mineral exports. In his social media post Wednesday, Trump claimed the US would impose tariffs on Chinese goods of 55 per cent.

But here’s the catch: White House officials were quoted as saying that the figure included tariffs put in place during Trump’s first term. So, while the 55 per cent tariff on imported Chinese goods might seem to retain a reasonable differential over the tariffs imposed by the US on India, this figure includes a 25 per cent pre-existing tariff that was imposed by Trump in his first term, and that the Biden administration persisted with. The remaining components of this 55 per cent tariff are the 10 per cent baseline “reciprocal” tariff and the 20 per cent tariff imposed initially by the Trump administration on China citing fentanyl trafficking. So, the effective tariff calculation on China should ideally exclude the 25 per cent pre-existing tariff, which pretty much negates the impression of a sizable tariff difference with India; at least for now.

“We are getting a total of 55 per cent tariffs, China is getting 10 per cent. Relationship is excellent!” Trump wrote in his post, without elaborating. Even this, however, is subject to a “final approval” by both Presidents, which means concurrence by Chinese President Xi Jinping. There has been no reaction so far from Beijing on Trump’s social media post that effectively declared a victory of sorts in the trade war with China – ostensibly aimed at the domestic audience.

Story continues below this ad

Third, China is putting a six-month limit on rare earth and magnet export licenses for US automakers and manufacturers, The Wall Street Journal reported on Wednesday citing unnamed sources. The measure, according to analysts, is expected to provide Beijing with additional leverage in trade discussions and raise uncertainty for American industries dependent on these materials.

The upside for India

The upside for India is that the trade deal under discussion with the US, which New Delhi is working to clinch before July 19, could see a further drop in tariffs from the current 26 per cent to closer to 10 per cent, the baseline tariff that the Trump administration is likely to persist with in the medium term. The problem, though, is that China’s leverage in its trade discussions with the US could mean a further downward revision in tariffs from the effective 30 per cent that was arrived upon at the Geneva talks and seems to have been ratified in the London discussions. Though the details of the deal were still unclear, analysts predicted that China seems to have gained the upper-hand after its rare earth restrictions prompted US carmakers, including Ford Motor and Chrysler, to cut production.

Chinese state media said earlier Wednesday that Beijing had reached a “framework” for an agreement with the US during talks in London, but there was no official response from China on Trump’s subsequent claims on Truth Social.

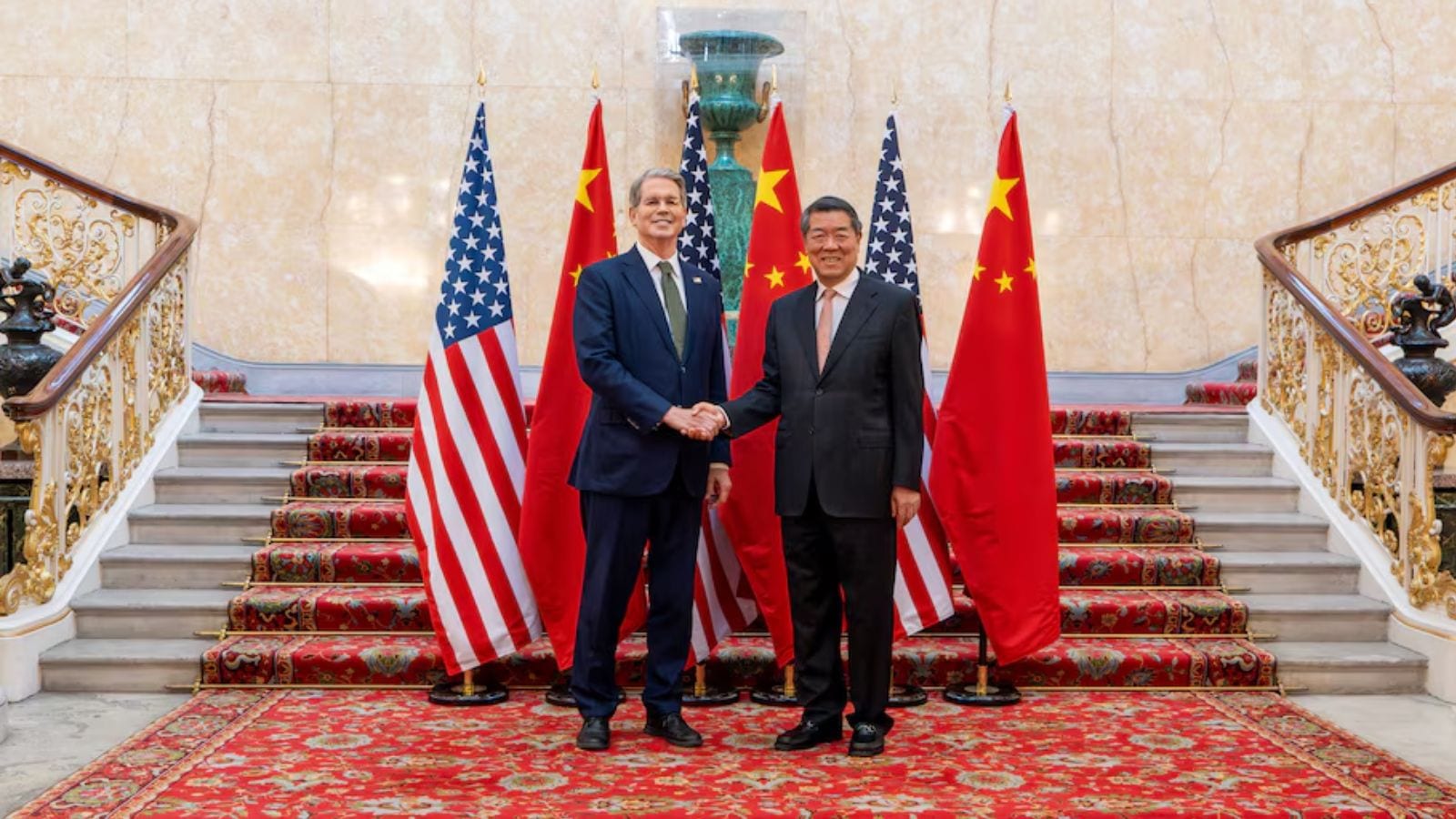

Earlier, both the negotiating sides said they had agreed in principle to a framework for dialling down trade tensions between the world’s two biggest economies. After the meeting in London — the second time the two sides have met in the last couple of months, since Trump’s sweeping tariff onslaught — there were indications of a reconciliation. The London meeting follows a call between Trump and Xi on June 5, which was initiated by the White House — the first call since Trump’s reciprocal tariff announcement.

Story continues below this ad

How US-China trade talks are shaping up

What is, however, beginning to get clearer after the second meeting is that this is perhaps not how the US imagined the trade war to unfold. China is beginning to dictate the direction of the bilateral talks, with the US almost seen as requesting for much-needed concessions on the resumption of supplies of critical inputs.

In the first round of talks in Geneva, the US delegation led by Treasury Secretary Scott Bessent had asked the Chinese to cut its tariffs in tandem with theirs, primarily because the Americans were facing the heat back home from the early fallout of the high tariffs, including empty shelves at grocery stories and surging prices of daily use commodities.

In London, the US side is learnt to have specifically asked the Chinese to “suspend or remove” restrictions on rare earths magnets, which had forced a supply-chain crunch. Chinese export controls over rare earth minerals were high on the agenda of the meetings. While Beijing has not imposed an outright ban on the export of rare earth magnets, the process has been made very difficult; it could take a long time to source, posing shortage risks.

Rare earth magnets, especially neodymium-iron-boron (NdFeB) magnets, are crucial for EV manufacturing. They provide the strong magnetic fields needed for efficient and powerful electric motors, including traction motors that drive EVs. These magnets also play a major role in other EV components like power steering systems, wiper motors and braking systems. China has a virtual stranglehold over these rare earth magnets.

Story continues below this ad

US Trade Representative Jamieson Greer had said China had failed to roll back restrictions on exports of rare earth magnets. In the run-up to this week’s talks, the Chinese Ministry of Commerce said on Saturday that it had approved some applications for rare earth export licences.

The advantage wrested by the Chinese side by leveraging its strategy of weaponing its dominance in key sectors was a factor in the run-up to the London talks. Rare earth minerals and magnets is one such area, where the US is now desperate for concessions. Both sides have since claimed breaches on non-tariff pledges, but the Americans clearly seem more eager for a reconciliation, given the impact of the Chinese blockade on its key manufacturing sectors.

China also has a stranglehold over other items such as active pharmaceutical ingredients, and control over elements that go into the battery manufacturing, including lithium and cobalt.