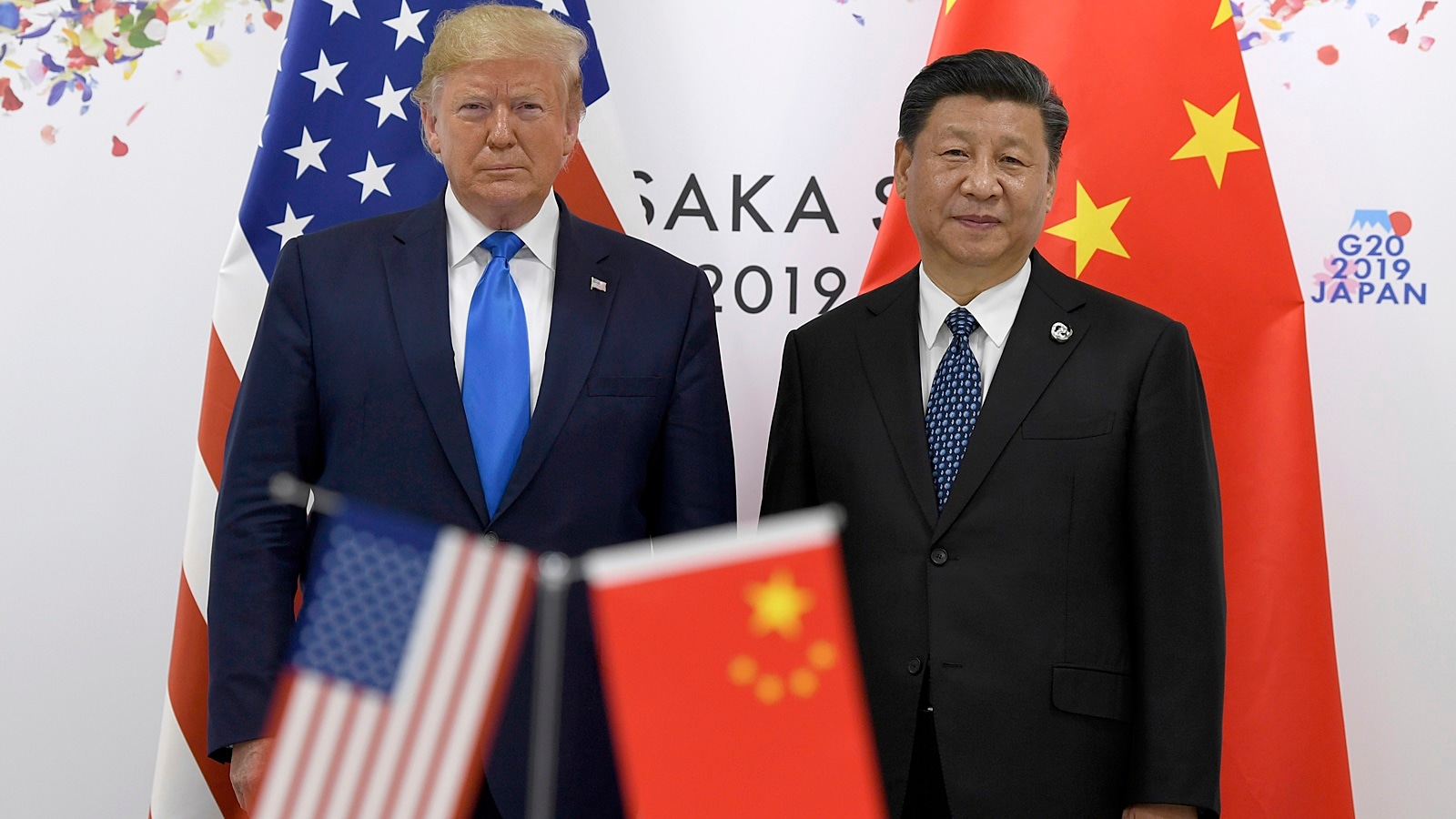

President Donald Trump said Wednesday that the United States has reached a trade agreement with China, including an easing of curbs imposed by Beijing on export of rare earth minerals and magnets that are key inputs for industries ranging from automobiles to electronics.

“Our deal with China is done, subject to final approval with President Xi and me,” Trump said in a post on Truth Social. He said China would supply “any necessary rare earths” and magnets, while the US would make concessions on allowing Chinese students to attend American universities. The Trump administration had recently begun to clamp down on the presence of Chinese nationals on US college campuses.

“We are getting a total of 55% tariffs, China is getting 10%. Relationship is excellent!” Trump wrote, without elaborating.

Bloomberg quoted a White House official as saying that the agreement allows the US to charge a 55 per cent tariff on imported Chinese goods, which, crucially, includes a 10 per cent baseline “reciprocal” tariff, a 20 per cent tariff for fentanyl trafficking, and a 25 per cent tariff reflecting pre-existing tariffs (imposed by Trump in his first term, that the Biden administration persisted with).

China would charge a 10 per cent tariff on American imports, the official said.

Though the details of the deal were still unclear, analysts predicted that China seems to have gained the upper-hand after its rare earth restrictions prompted US carmakers, including Ford Motor and Chrysler, to cut production.

Significantly, Trump said a final deal is subject to approval from him and Chinese President Xi Jinping. Chinese state media said earlier Wednesday that Beijing had reached a “framework” for an agreement with the US during talks in London, but there was no official response from China on Trump’s subsequent claims on Truth Social.

Story continues below this ad

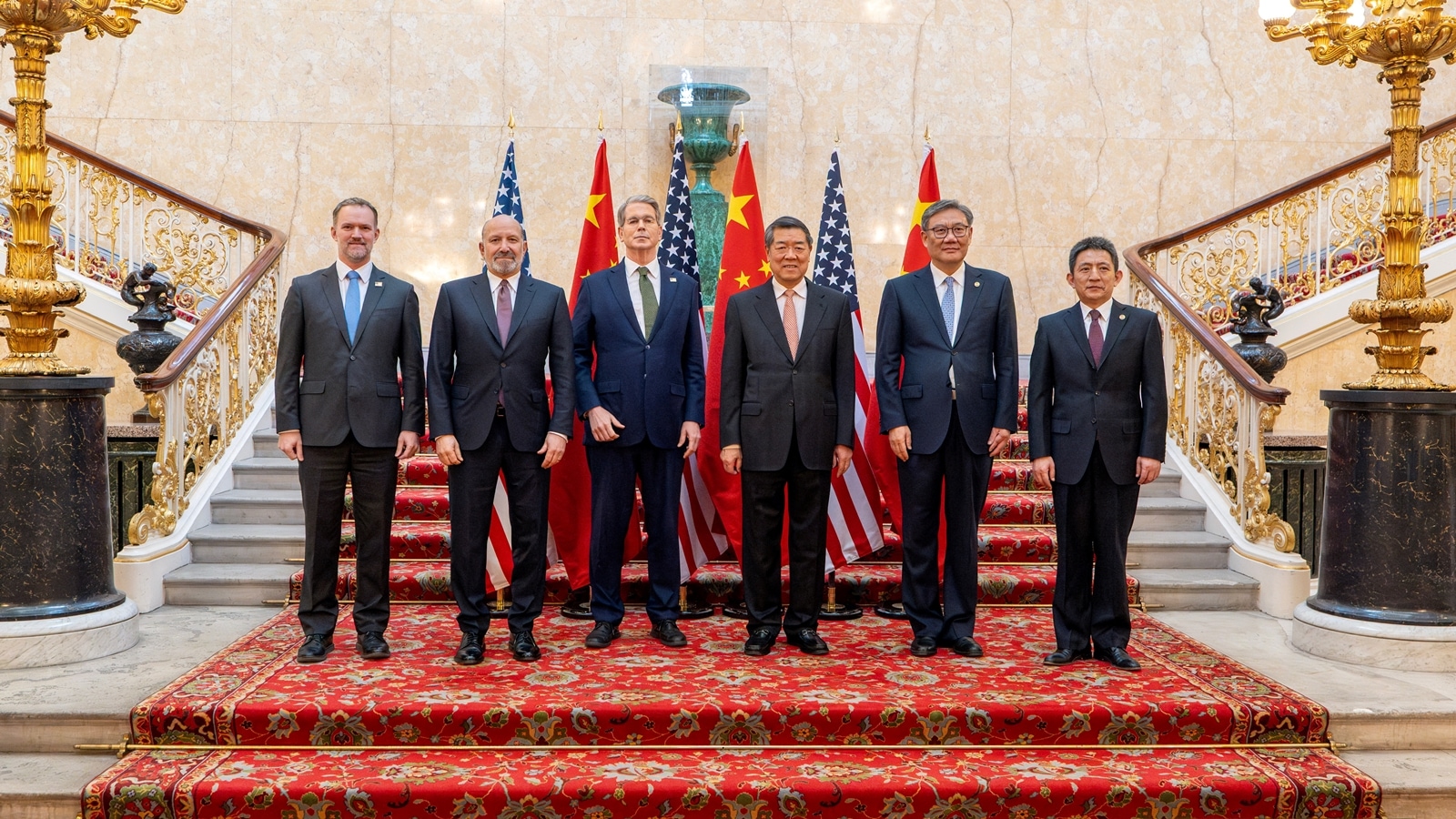

The US and China teams in London on Tuesday. (Reuters)

The US and China teams in London on Tuesday. (Reuters)

Earlier, both the negotiating sides said they had agreed in principle to a framework for dialling down trade tensions between the world’s two biggest economies. After the meeting in London — the second time the two sides have met in the last couple of months, since Trump’s sweeping tariff onslaught — there were indications of a reconciliation.

What is beginning to get clearer after the second meeting is that this is perhaps not how the US imagined the trade war to unfold. China is beginning to dictate the direction of the bilateral talks, with the US almost seen as requesting for much-needed concessions on the resumption of supplies of critical inputs.

In the first round of talks in Geneva, the US delegation led by Treasury Secretary Scott Bessent had asked the Chinese to cut its tariffs in tandem with theirs, primarily because the Americans were facing the heat back home from the early fallout of the high tariffs, including empty shelves at grocery stories and surging prices of daily use commodities.

In London, the US side is learnt to have specifically asked the Chinese to “suspend or remove” restrictions on rare earths magnets, which had forced a supply-chain crunch. The London meeting follows a call between Trump and Xi on June 5, which was initiated by the White House — the first call since Trump’s reciprocal tariff announcement.

Story continues below this ad

After the London talks, US Commerce Secretary Howard Lutnick said the deal should result in restrictions on rare earth minerals and magnets “being resolved”. “We have reached a framework to implement the Geneva consensus… Once the Presidents approve it, we will then seek to implement it,” he said.

“The two sides have, in principle, reached a framework for implementing the consensus reached by the two heads of state during the phone call on June 5 and the consensus reached at the Geneva meeting,” the BBC quoted China’s Vice Commerce Minister Li Chenggang as saying.

Chinese export controls over rare earth minerals were high on the agenda of the meetings. While Beijing has not imposed an outright ban on the export of rare earth magnets, the process has been made very difficult; it could take a long time to source, posing shortage risks.

Rare earth magnets, especially neodymium-iron-boron (NdFeB) magnets, are crucial for EV manufacturing. They provide the strong magnetic fields needed for efficient and powerful electric motors, including traction motors that drive EVs. These magnets also play a major role in other EV components like power steering systems, wiper motors and braking systems. China has a virtual stranglehold over these rare earth magnets.

Story continues below this ad

In May, talks held in Geneva led to a temporary truce after the tit-for-tat tariff increases by both sides, which led to duties that peaked at 145 per cent. Trump called the outcome of the talks in Switzerland a “total reset”, which brought US tariffs on Chinese products down to 30 per cent, while Beijing cut duties on US imports to 10 per cent. Both sides also agreed to a 90-day deadline to try to reach a trade deal.

However, the US and China have since accused each other of breaching the deal. The US has said that Beijing has been dragging its feet on opening up exports of rare earth metals and magnets while the Chinese claim that Washington has restricted its access to American goods such as semiconductors and other related technologies linked to artificial intelligence.

US Trade Representative Jamieson Greer had said China had failed to roll back restrictions on exports of rare earth magnets. In the run-up to this week’s talks, the Chinese Ministry of Commerce said on Saturday that it had approved some applications for rare earth export licences.

The problem for the US is that the Chinese side has wrested some advantage, especially by leveraging its strategy of weaponing its dominance in key sectors. Rare earth minerals and magnets is one such area, where the US is now desperate for concessions. Both sides have since claimed breaches on non-tariff pledges, but the Americans clearly seem more eager for a reconciliation, given the impact of the Chinese blockade on its key manufacturing sectors.

These Chinese trade blockades are already impacting companies in other geographies. Hamamatsu-based small car maker Suzuki Motors, for instance, said last week it plans to suspend the production of its flagship Swift compact hatchback due to China’s rare earth restrictions, becoming the first Japanese automaker to be impacted. There are similar worries among other manufacturing entities across the world, including in the US.