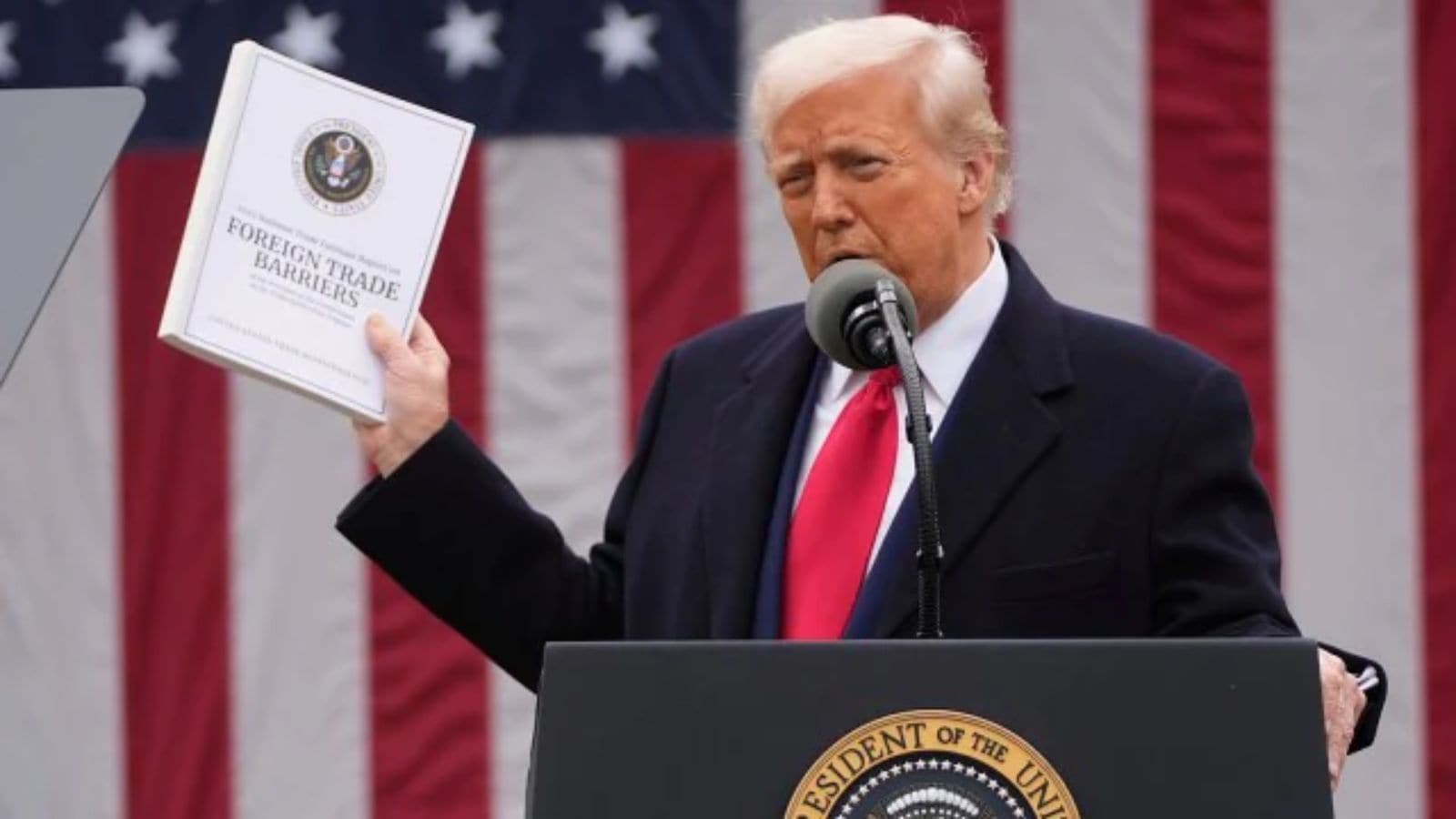

April was one of the most important months in the world’s economic history, with the Trump administration’s reciprocal tariffs coming into force on April 2 before being put on pause for 90 days a week later. The threat of the reciprocal tariffs, however, has seemingly had the opposite effect as American companies stocked up ahead of the tariffs’ rollout.

Data released last week showed that while the US’ goods and services trade deficit in April 2025 fell a record 55 per cent from March 2025 to a 19-month low of $61.6 billion, the deficit for the first four months of 2025 was up 66 per cent compared to a year ago.

The basis of Trump’s reciprocal tariffs was that it would help bring down the US’ trade deficit with various countries. Take India, for instance, which enjoyed a total trade surplus of $46.09 billion with the US in 2024. However, India’s merchandise trade surplus with the US for the first four months of 2025 increased by 45 per cent to $23.29 billion, with imports from India up 29 per cent according to latest data from the US commerce department. In January-April 2025, the US imported $9.49 billion of advanced technology products from India, up 86 per cent from a year ago.

Consumers & farmers

American consumers have, for long, been considered the biggest losers in the Trump administration’s pursuit of balanced trade. According to non-partisan policy research center The Budget Lab at Yale, American households, on average, are facing a consumption loss of $2,500 in 2025 when prices are measured in 2024 levels. “The post-substitution price increase settles at 1.3%, a $2,100 loss per household,” The Budget Lab at Yale said.

The Budget Lab estimates that Americans are facing an overall average effective tariff rate of 15.6 per cent at present — the highest since 1937 — with segments such as clothing and textiles being affected the most. In the short run, shoe and apparel prices for US consumers are up 31 per cent and 28 per cent, respectively.

Despite the pain from tariffs, some in the US are still upbeat; in fact, more so than in several years. The Purdue University-CME Group Ag Economy Barometer index climbed to a four-year high last month, suggesting improved sentiment among farmers due to a “much more optimistic view of US agricultural export prospects, combined with a less negative view of tariffs’ impact on 2025 farm income than respondents provided in either March or April”.

Exports are indeed on American farmers’ minds, with Agriculture Secretary Brooke Rollins having recently visited Italy as part of her “aggressive travel agenda to promote American agriculture worldwide”. The trip to Italy follows one to the UK in May 2025, with India, Vietnam, Japan, Peru, and Brazil on Rollins’ schedule over the coming months.

Shifting views on free trade

Story continues below this ad

Rather ironically, even as US and Chinese officials meet in London on Monday to add to the preliminary agreement that was agreed last month, American farmers have over the years grown somewhat skeptical of how beneficial free trade is.

As per the Purdue University-CME Group Ag Economy Barometer, 18 per cent of producers in May 2025 either disagreed or strongly disagreed when presented with the statement that ‘free trade benefits agriculture and most other American industries’. Back in December 2020, the corresponding number was just 7 per cent.